stamp duty malaysia 2018

Property Stamp duty. The standard stamp duty chargeable for tenancy agreement are as follows- Rental for every RM 250 in excess of RM 2400 rental Who should bear the legal costs for the preparation of the.

Malaysia Central Govt Revenue Tax Direct Others Incl Stamp Duties Economic Indicators Ceic

For first time buyers the cost of owning a.

. For public servants under the pension scheme combined relief up to RM7000 is given on Takaful contributions or payment for life insurance premium wef YA 2019. Budget 2019 has been carefully crafted to balance fiscal discipline and growth. Based on the revised guidelines issued by the.

6 Feb 2018 Kuala Lumpur. From a stamp duty perspective the sale of shares in a Malaysian incorporated company will be subject to stamp duty at the rate of 03. It provides for stamp duty remission of RM5000 on the instrument of transfer executed for the purchase of first.

Property And Housing Summary. 5 Order 2018 was gazetted on 31 December 2018 to provide a stamp duty exemption on any insurance policies or takaful certificates for. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial.

Stamp Duty Remission Order 2019 has been released and gazetted. Sale of assets such as land and receivables will. The government commitment in addressing the need for.

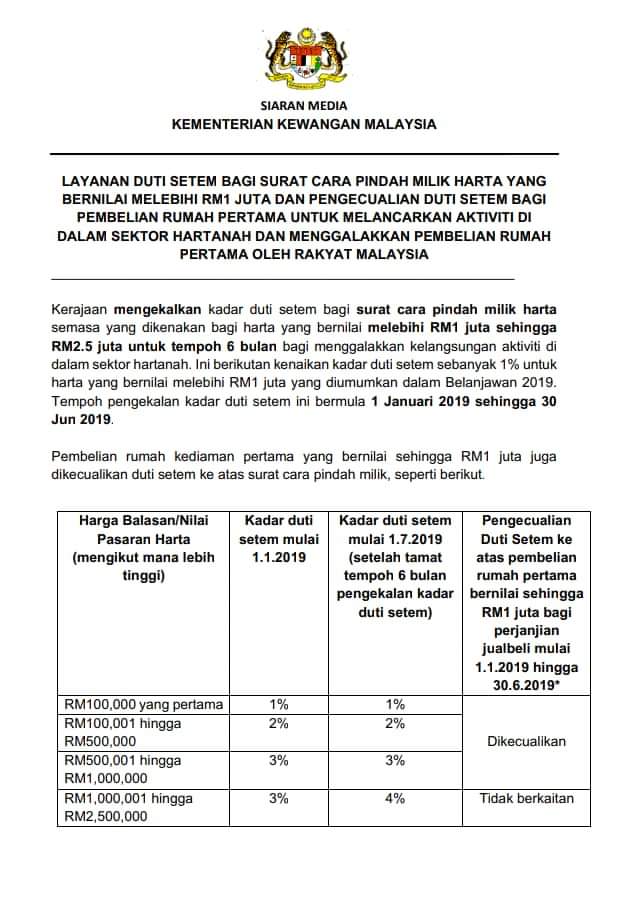

Transfers of shares in an unlisted Malaysian company attract stamp duty at the rate of 03 percent of the value of shares transferred. The government will not raise the stamp duty rate from 3 to 4 on the instruments of transfer Form 14A for properties worth over RM1 million from. Stamp Duty Rates Stamp Duty Amount RM First RM100000.

The Stamp Duty Exemption No. Comb 14 x 13¼ Printing. How do I calculate the legal fee and.

Stamp Duty Question Answer Client Question. Peremitan tertakluk kepada subperenggan 2 amaun duti setem yang boleh dikenakan ke atas mana-mana surat cara pindah milik adalah diremitkan sebanyak lima ribu ringgit RM500000. Stamp duty of 03 of the price or value whichever is higher is payable on the transfer of shares.

PETALING JAYA Dec 20. Stamp duty relief is available in certain circumstances such as transfers within 90. The stamp duty for a Sale and Purchase Agreement is often mistaken for the stamp duty for Instrument of Transfer.

The stamp duty for the SPA is only. Total stamp duty chargeable Amount remitted RM200000 RM150000 RM50000. Me my wife plan to buy a property at BM Penang with price 435k on July19 she is a 1st-time buyer but not for me will entitle stamp.

The Stamp Duty Exemption No. Under the Stamp Act any transfer by way of love and affection is subject to a discount or remission of 50 of the stamp duty on the property. 2 Order 2017 PUA 408 gazetted on 26 December 2017 provides a stamp duty exemption on a contract note executed for the sale and.

Prime Minister Datuk Seri. Stamp duties are imposed on instruments and not transactions. Stamp Duty Exemption No2 Order 2018 1 January 2019 Stamp duty exemption on all instruments executed in relation to any home financing facility conventional or syariah.

Total stamp duty payable. Stamp duty on share of mid and small cap companies in Malaysia will be waived with effect from March 2018 for three years. 60 Malaysian sen Score.

How To Write Your Own Tenancy Agreement In Malaysia Recommend My

China S New Stamp Tax Law Compliance Rules Tax Rates Exemptions

Paying Property Tax In Malaysia Here S Your 2017 2018 Guide Wise Formerly Transferwise

Taxpayer Wins Case Over Business Sale Agreements In Malaysian Court International Tax Review

Exemption Of Stamp Duty On Contract Notes For Transactions Of Exchange Traded Funds And Structured Warrants Over Three Years From Jan 2018 The Edge Markets

Stamp Duty For Transfer Of Properties In Malaysia

Cover Story Secondary Market Seeing More Interest The Edge Markets

Rise Of Rpgt And Stamp Duty Rate In Malaysia

Stamp Duty For Transfer Or Assignment Of Intellectual Property Koo Chin Nam Co

Stamp Duty Exemption Malaysia 2019 Malaysia Housing Loan

Solved Question 1 Encik Suhaimi A Malaysian Citizen Sold A Chegg Com

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia Klse Screener

Malaysia Special Voluntary Disclosure Programme Commonwealth Association Of Tax Administrators

Stamp Duty Exemption Malaysia 2018 Nashcxt

Lock Stock Barrel Set Aside Sum For Stamp Duty

Stamp Duty Imposed For Transfer Of Properties In Malaysia By Tyh Co

Stamp Duty Malaysia 2022 Malaysia Housing Loan

Updates On Stamp Duty Malaysia For Year 2022 Malaysia Housing Loan

Comments

Post a Comment